Rates FAQs

How much are my rates?

You can contact us to find out how much your rates are, or look up your property on our Rates Search.

Can I receive my rates invoices by email?

Yes, click here to sign up to receive your rates invoices by email. If you have already signed up, and would no longer like to receive your rates by email you can opt out using the same form.

What happens if I miss a payment?

The following penalties on unpaid rates will be applied:

- A charge of 10% on so much of any instalment that has been assessed after 1 July 2024 and which remains unpaid after the due date for that instalment.

- A charge of 10% on so much of any rates assessed before 1 July 2024 which remain unpaid on 16 July or such later date as required under Section 58 (1)(b)(ii).

- A continuing additional penalty of 10% on so much of any rates levied before 1 July 2024, to which a penalty has been added under the immediately preceding bullet point, and which remain unpaid six months after the previous penalty was added. The penalty will be added on 23 January 2025.

These penalties are pursuant to Section 57 and 58 of the Local Government (Rating) Act 2002.

Penalties imposed are exempt from GST.

Ratepayers are reminded that payments must be received in the Council Office by 4:30pm on the final payment date.

Stratford District Council takes no responsibility for delays in the mail service or for the circumstances beyond Council's control.

Can I apply for a rates rebate?

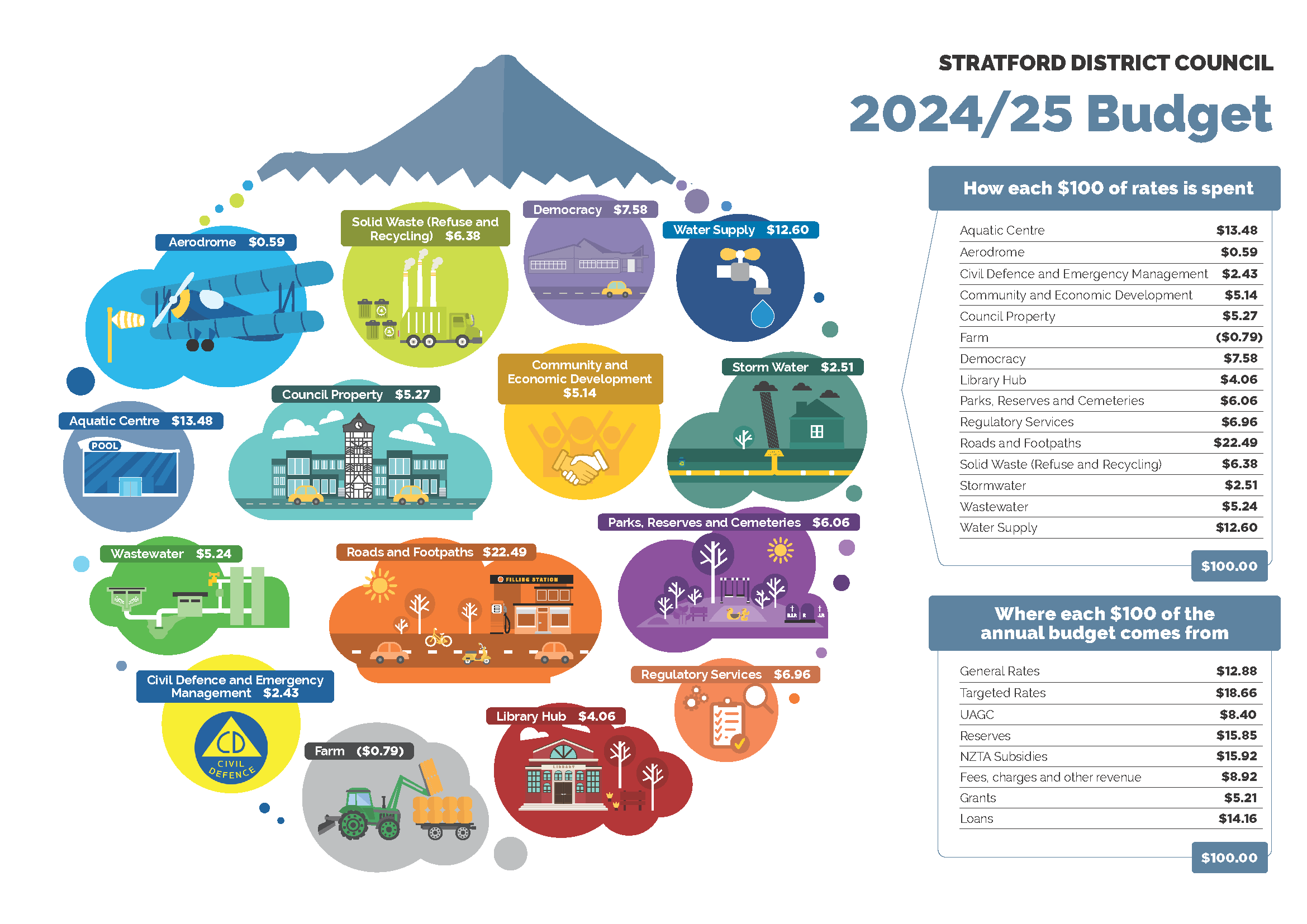

Where do my rates go?

Why are there Regional Council rates on my rates invoice?

Stratford District Council has an agreement with the Taranaki Regional Council (TRC) to collect rates on the TRC’s behalf.

Our role in this matter is as a collection agency only. If you have any queries regarding the Regional Council rates or services, please direct them to the Taranaki Regional Council, phone 06 765 7127.

What is a property revaluation?

A rating valuation is a three-yearly assessment of a property's value and is determined by house sale prices (excluding chattels) on a specific date. We use these valuations as a guide for setting your rates.

Quotable Value (Council’s valuation service provider) determines the value by looking at the selling price of similar properties in the area.

A few weeks after revaluations are done, you will receive a rates valuation notice in the post. If you disagree with the value, you can object by contacting QV within the timeframe provided and a new valuation will be carried out at no charge.

Outside of the designated objection timeframe, you can still ask for a revaluation but this will come at a cost.

How is my property valued?

A property value is made up of three parts:

- Capital value (CV) - The most likely selling price at the date of valuation. It's the land value and improvement value added together. The CV is also known as Government valuation (GV) or Rateable value (RV).

- Land value (LV) - The most likely selling price of the vacant land at the date of valuation.

- Improvement value (IV) - The added value of improvements to the vacant land. This is calculated as CV minus LV. The IV is not an assessment of the replacement cost and should not be used for insurance purposes.

Property value changed?

In 2023 properties in the Stratford District were revalued and we have used these new valuations to determine how much you will pay in rates for the 2024/2025 financial year. Some properties in our district have seen a significant rise in capital value while others have pretty much remained unchanged. For this reason, you may see a wider range in the rates increases than usual.

There are a number of misconceptions about property valuations and Council collecting rates. People often think that an increase or decrease in valuation will automatically result in an increase or decrease in rates.

Many people also think that an increase in the district’s values will mean that the Council gets more money. This is not true. Council does not collect more rates as a result of increased property values or less rates if values decrease. But your property’s new value will help determine the share of the total rate revenue you pay.

Here's how it works (please note, the numbers used are fictional to explain how it works):

- The rate calculation starts with a total council budget, which is then split across the total value of rateable properties in the district.

- Council sets an annual budget for general rates – say $10 million - $10,000,000

- The total value of rateable properties in the district is say a billion - $1,000,000,000

- You then divide the budget by the total value of rateable properties: $10 million divided by a billion, this gives you $0.01 rates per dollar of property value.

- If your house is worth $300,000, your general rates would be $3,000.

If every property in the district doubled in value, you would get the same result. This is because you would divide it by twice the amount (because the total value doubled) but then also multiply it by twice the amount (because the value of the individual property doubled) – because it starts with the budget council has set to start with.

We are only collecting the set budget, no matter what happens to property values.

What makes it confusing is that different types of properties increase/decrease in value differently between valuations. For some time farms were going up a lot more than residential properties, meaning farmers carried the majority of the increases. At the moment residential is seeing stronger value growth, therefore the increase has been higher in the residential properties.

What period do my rates cover?

The rating year is from 1 July to 30 June the following year.

There are four equal instalments which are billed quarterly and due on the following dates:

- 28 August 2024 (for the period 1 July to 30 September)

- 27 November 2024 (for the period 1 October to 31 December)

- 26 February 2025 (for the period 1 January to 31 March)

- 28 May 2025 (for the period 1 April to 30 June)

Due dates must be strictly adhered to, as payments received after these dates will incur a 10% penalty.

Remember to allow sufficient postal time for payments as we cannot be held responsible for mail that does not reach us on time.

When will I receive my rate notice?

Rates notice are always sent the 1st day of the month they are due, 1 August, 1 Nov, 1 Feb and 1 May. If you prefer to receive your rates notices by email, let us know by completing our online form here.

Is there GST on rates instalments?

All rates and charges are inclusive of GST, a tax invoice is generated for each instalment. There is no GST on penalties.

Can I have my penalty remitted?

Yes, we can provide a rates remission on penalties to ratepayers who have been unable to pay rates by the penalty due date, because of circumstances outside the ratepayer's control. They must meet the conditions and criteria of our rates remission policy which we've provided below:

Conditions and Criteria

On application by the ratepayer, a remission of an instalment penalty imposed under Section 58(1)(a) of the Local Government (Rating) Act 2002 will be granted if this is the first instance of late payment by the ratepayer within the previous three rating years and the following criteria are met:

- Where a property changes hands (sale or lease) and the new owner/lessee is responsible for an instalment when the original account was issued in the name of the previous owner/lessee.

- On compassionate grounds, i.e., where a ratepayer has been ill or in hospital or suffered a family bereavement or tragedy of some type, and has been unable to attend to payment (elderly persons living on their own etc.). Or if the ratepayer satisfies the Council that they had the ability to pay, however late payment was due to circumstances outside the ratepayer’s control, therefore they were unable to come into council to make payment.

- The rate invoice was not received, where it can be proved that it was not due to negligence by the ratepayer.

- Where an error has been made by Council staff which has subsequently resulted in a penalty charge being imposed.

- In the case of a deceased estate, upon receipt of a letter from a Solicitor who has been granted probate, that while the winding up of the affairs of the estate are in progress and that Council may expect full payment of rates, Council may remit penalties from the time of death.

Where a ratepayer enters into a direct debit arrangement for the payment of the current year rates and any rate arrears, further penalties will be granted a remission. However, any default in the arrangement will cause the remission to be cancelled from the date of the default. Any penalties applied up to the date of commencement of the arrangement will remain.

Council may remit up to 100% of the penalties (or other figure) charged to a property, where a property has sold and a settlement request has been received by council from a Solicitor prior to a Rates Instalment Due date.

Council may remit up to 100% (or other figure) of the penalties charged to a property, where the ratepayer can demonstrate that there are circumstances outside of their control which have caused the rates to incur a penalty, and where the rates are paid in full on an agreed date.

Can I change the name on my rates notice?

If the change is just a spelling mistake, you can let us know over the phone or by emailing rates@stratford.govt.nz

If you've changed your name by marriage or divorce, the Local Government Rating Act requires you to notify the relevant Local Authority within 1 month of the registration of name change in the land transfer register. The name on your rates notice will only be changed if it has been recorded on the title.

If the change is a business name (e.g. partnership or trust) we must be notified of the change of ownership via a solicitor.

If a ratepayer is deceased and the remaining owner wishes to remove their name, verification from a solicitor is required.

What do I do if I haven't received my rates notice?

Contact our Service Centre to check that the mailing address we hold on our database is correct, if changes are required you can you can let us know over the phone 06 765 6099 or by emailing rates@stratford.govt.nz

If NZ Post has returned any rates notices, the rates team will hold these until we're able to find a current address.

I have bought a property, why haven't I received a rates notice for it?

Contact our rates team on 06 765 6099 or email rates@stratford.govt.nz to check that a Notice of Sale has been received to show you are the new owner. If Stratford District Council has not yet received a Notice of Sale, you will need to get in touch with your solicitor to ask that this be provided as we are unable to change the owner details without it.

If we received the Notice of Sale between generating and posting of the rates invoice, we can forward a copy of the updated rates notice to you.

I have sold my property, why have I received a rates notice for it?

Contact our rates team on 06 765 6099 or email rates@stratford.govt.nz to check that the Stratford District Council have received a Notice of Sale. If we haven't you will need to get in touch with your solicitor, as this is a change of ownership we need confirmation via a Notice of Sale via a solicitor.

I have sold part of my property, why have I received a rates notice for the whole of my property?

You can email the rates team on rates@stratford.govt.nz to resolve this.

I have recently subdivided my property, why have I received the rates account for the entire property?

All properties that were subdivided and Council received the new title information prior to 30 June 2024, have been rated accordingly from 1 July following the issue of title.

For subdivisions outside of this period, you can email the rates team on rates@stratford.govt.nz to resolve this.

I own adjoining properties, do I have to pay targeted rates on all properties?

Under new legislation, a separate title is deemed to be a separate rating unit. However, properties can be deemed to be contiguous if ratepayers meet the following criteria:

- The properties are owned by the same person/persons AND

- Used jointly as a single property AND

- Separated only by road, railway, drain, water race, river or stream.

In most rural cases where there is more than one title, they haven't been separated as it is obvious that the property is one farm and used as that.

Two urban properties that each have a dwelling cannot be deemed to be contiguous.

When will my new building be rated?

Valuation of your new building will be undertaken by our valuers at preline stage. Once we receive the new values the property will have rating amended from 1 July following the valuation.

Do I have to pay additional Uniform Annual General Charges (UAGC's) on adjoining properties?

UAGC's will be applicable on all adjoining properties, however if the adjoining property is vacant a remission of the UAGC will be applied.

Can I get another copy of my rates notices?

Sure! Contact our Service Centre on 06 765 6099, email rates@stratford.govt.nz or complete our Contact Us form here.